Are you doing your research on a specific car from different websites and dealerships? Whether you’re a first-time car buyer or a savvy car shopper, getting multiple quotes is a great way to compare prices and options.

Here are some tips on how to do your research and get a quote for cars in 2022.

Likewise, we’ll include every important detail like car insurance quote, auto insurance coverage, auto policy, insurance companies, safety features, medical expenses in case of an at-fault accident, bodily injury, coverage limits, financial protection, car insurance rates, etc.

With that said, we aim to help you get the most comprehensive research on how to help you get the best car insurance quote from different car insurance companies and help you save money. So, without further ado, let’s get started!

What you need to consider

Getting multiple quotes is the best way to ensure you’re getting a fair price on your car.

When you’re doing your research, be sure to consider the following:

- The make and model of the car you’re interested in

- Your budget

- Your driving history

- Your credit score

- The type of coverage you’re looking for

- The deductibles you’re willing to pay

- The discounts you may be eligible for

Once you have all of this information, you can start shopping around for car insurance. Be sure to compare apples to apples when getting quotes from different companies.

In other words, make sure you’re comparing the same coverage limits, coverage options, liability coverage, collision coverage, deductibles, and discounts.

Best websites to research cars

There are multiple car websites available right now to help you with your research.

These websites will give you plenty of information about different makes and models of cars, as well as pricing information. You can also find user reviews on many of these websites, which can help make your decision.

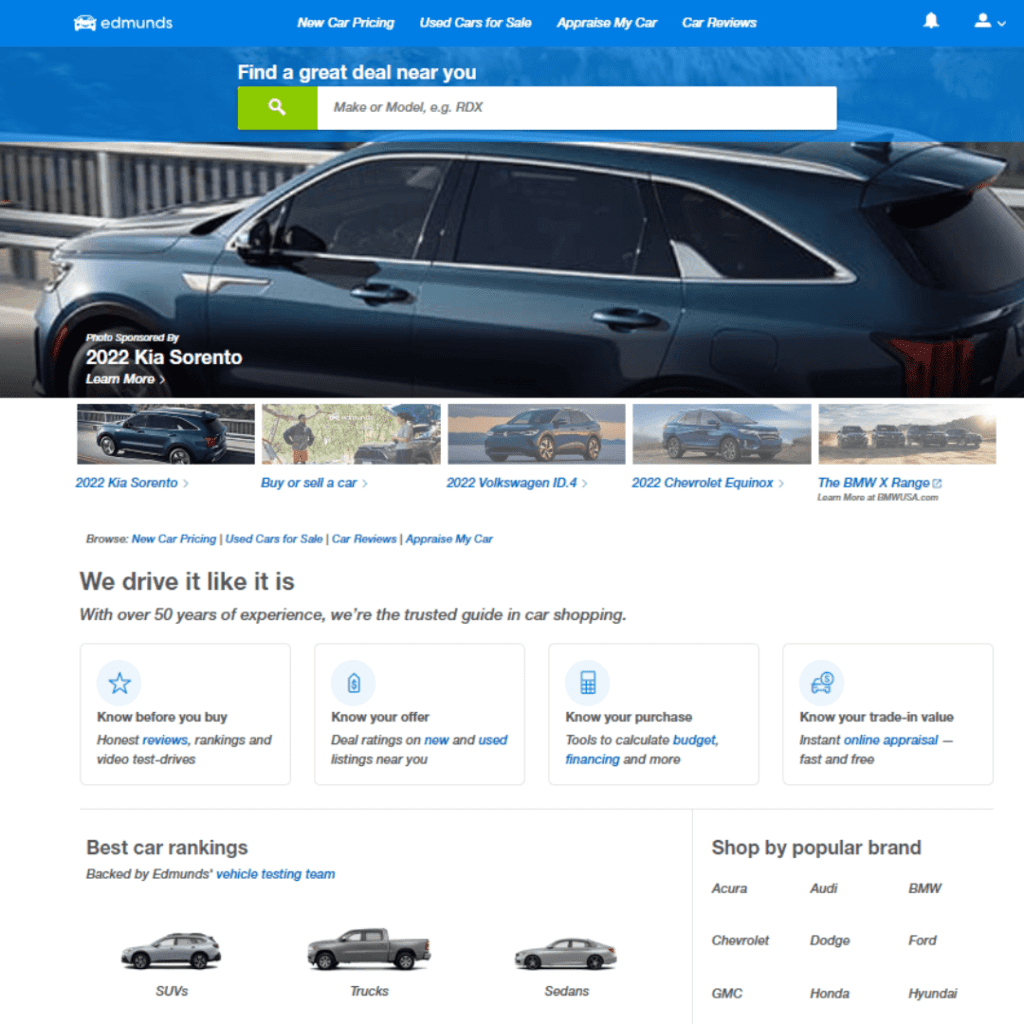

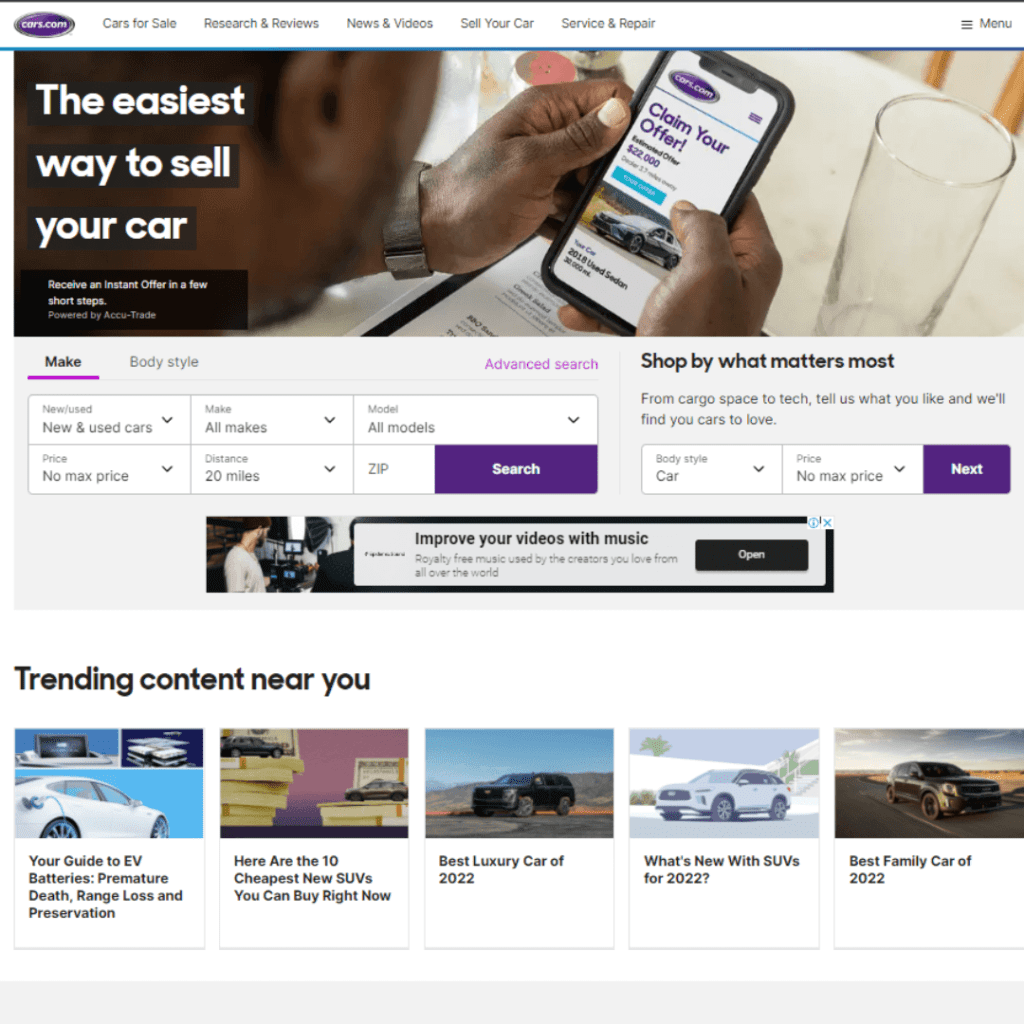

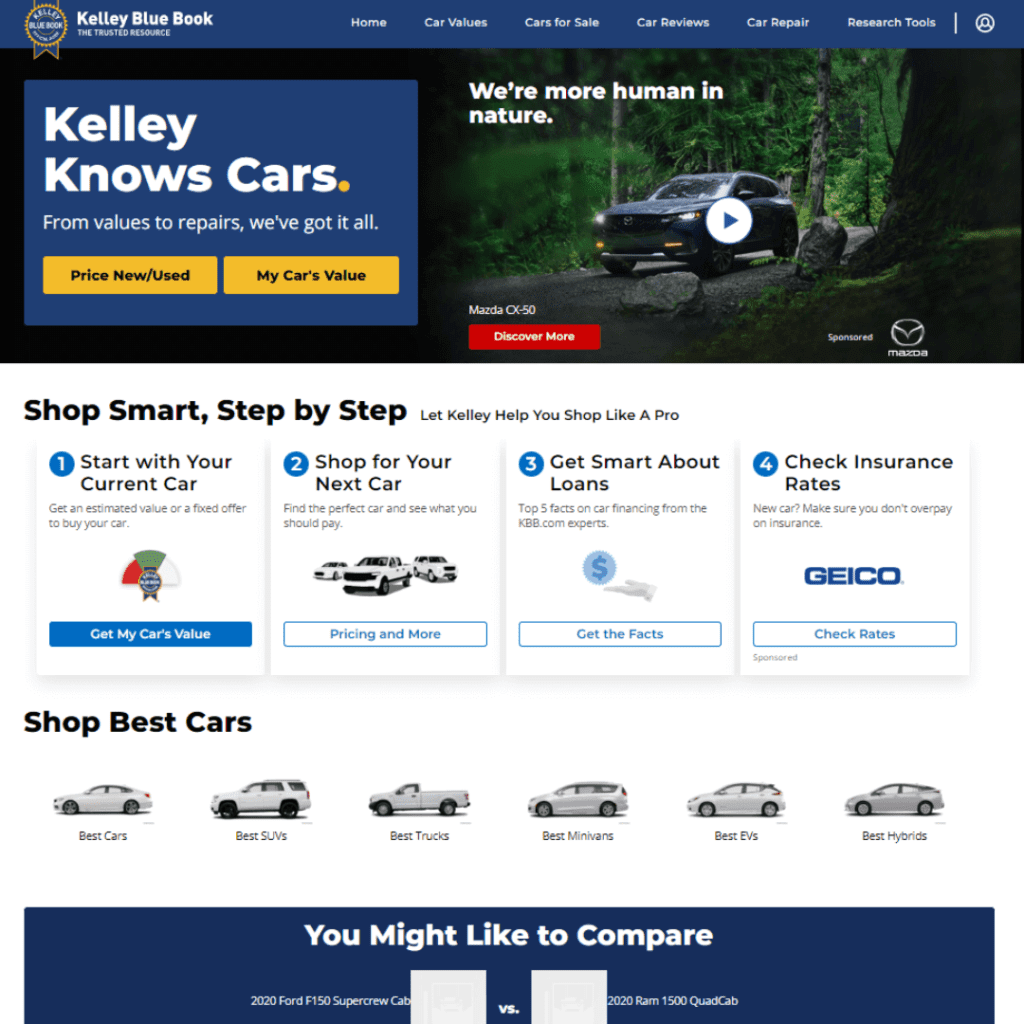

Some good car research websites include Edmunds, Kelley Blue Book, and Cars.com. These websites should be able to give you everything you need to know about the car you’re interested in.

One website that received high marks for its car research capabilities is Edmunds. Edmunds provides detailed information on different makes and models of cars and allows users to compare cars side-by-side. The website also offers tips on car buying, financing, and leasing.

Cars.com is another website that offers a lot of helpful information for car shoppers. In addition to providing detailed information on different makes and models, the website also has a search tool that lets users find cars based on their zip code. Cars.com also offers user reviews, dealer ratings, and price comparisons.

Kelley Blue Book is a popular website that provides information on new and used cars. The website also offers a car payment calculator, trade-in value estimator, and fuel economy guide.

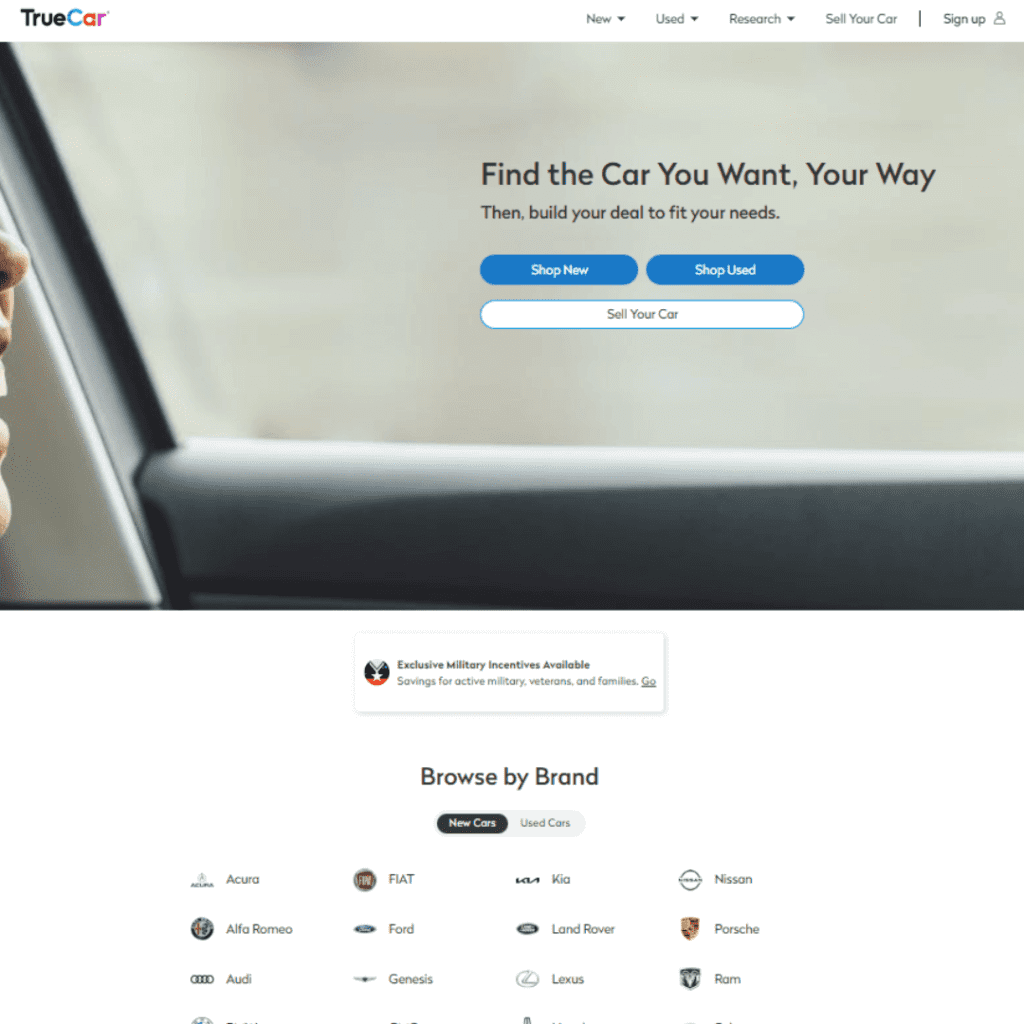

TrueCar is an online car-buying service that provides quotes from multiple dealerships in your area. One website is useful for getting quotes from multiple dealerships.

These are just a few of the many websites available to help you with your car research. By taking advantage of all the resources available to you, you can make sure that you find the perfect car for your needs.

When using this website, make sure to enter the same information for each quote including the make and model of the car, the year, the trim level, and the options you want. This will ensure that you’re comparing the same vehicles.

How do you ask for a car for a quote?

When you get quote for car, be sure to enter the same information for each quote. This includes the make and model of the car, the year, the trim level, and the options you want. This will ensure that you’re comparing apples to apples.

In perspective, your quote should include the following:

- A complete description of the car: year, make, model, exterior and interior colors, and all options.

- The price of the car.

- A breakdown of all fees, including sales tax, documentation, and registration fees.

- Safety features

You can use online pricing guides such as Kelley Blue Book or Edmunds to look up the manufacturer’s suggested retail price — also known as the sticker price — beforehand. That way, you can easily compare the MSRP with your offers to see the discount each dealership is offering.

How to get car insurance coverage

An auto insurance policy is required in most states and it’s important to have insurance that meets your needs. There are a few different types of coverage options available, and the type you need will depend on your circumstances.

However, it’s best to get full coverage insurance if possible because it will protect you financially if your car is damaged or stolen.

To get the best car insurance coverage, it’s best to ask multiple car insurance companies and compare car insurance quotes and insurance rates. You can also talk to an insurance agent and even independent agents to get more information about your options.

Likewise, it’s important to consider car insurance rate and auto insurance coverage when you’re researching and shopping for a new car. You can get car insurance quotes from multiple companies to compare rates and coverage options.

When it comes to car insurance, it’s important to know what you’re looking for and to compare different options. By taking the time to do your research, you can make sure you’re getting the best coverage for your needs.

What is an auto insurance quote?

An auto insurance quote differs from a car insurance policy. An auto insurance quote is an estimate of what your policy might cost, based on the information you provide. The final price of your policy will be determined by many factors, such as your driving record, the type of car you drive, and the amount of coverage you need.

What is an auto insurance policy?

An auto policy is a contract between you and an insurance company. It’s a legally binding agreement that outlines the terms of your coverage. Your policy will list the coverages and benefits included in your contract, as well as any exclusions or limitations.

It’s important to read your policy carefully so you understand what is and isn’t covered.

When you’re shopping for auto insurance, you can get auto insurance quotes from multiple companies to compare rates and coverage options.

Here are the different types of auto insurance coverage options:

Types of Insurance Coverage

There are four types of insurance coverage: comprehensive, collision, liability, and uninsured/underinsured motorist.

Comprehensive Coverage insurance covers damage to your car that is not caused by collisions, such as fire, theft, or vandalism. Collision insurance covers damage to your car that is caused by a collision with another car or object.

Liability coverage insurance is the most common type of auto insurance and it covers damage that you cause to other people or property. If you’re involved in at-fault accidents, liability coverage will pay for the repairs to the other vehicle and any medical bills incurred by the other driver.

Collision coverage insurance covers damage to your own vehicle if you’re involved in a car accident. This type of coverage is optional in most states, but it’s a good idea to have if you have a newer car.

Uninsured/underinsured motorist coverage protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages.

This type of coverage is important because it can help pay for your medical bills, car repairs, and even lost wages if you’re unable to work.

Look for car insurance quotes online

The best way to get multiple car insurance quotes is to use an online comparison tool. With an online comparison tool, like Liberty Mutual. You can enter your information once and get quotes from multiple insurers without having to contact each one individually.

How to get car insurance quotes

There are a few different ways to get car insurance quotes. The easiest way is to go online and compare car insurance quotes. You can also use different insurance comparison websites. With this method, you can get quotes from multiple car insurance companies with just a few clicks.

Another way to get car insurance quotes is to contact different insurance companies directly. This may take a bit more time, but it’s a good way to get an idea of what different companies are offering.

You can also talk to your family and friends to see if they have any recommendations. And, of course, you can always reach out to your local insurance agent. You can also ask multiple independent agents for quotes.

Keep in mind that the cheapest car insurance quote isn’t always the best. Be sure to compare coverage and deductible options to find the policy that’s right for you.

Whichever method you choose, be sure to get at least three quotes before making a decision. This will give you a good idea of what’s available and help you get the best possible rate.

For example, Liberty Mutual offers an online car insurance quote tool that can help you compare rates from different companies

What’s the best car insurance for rental cars?

If you’re leasing a car, it’s important to get full coverage insurance. This type of insurance will cover the damages to your car if it’s stolen or totaled in an accident. It will also cover any damage that you cause to another person or their property.

Getting multiple quotes is the best way to find the most affordable car insurance for rental cars. You can get multiple quotes by using an online insurance comparison website or by calling different insurance companies.

No matter what type of insurance coverage you need, it’s important to shop around and compare different car insurance rates before you buy a policy. You can use online car insurance quote tools to get multiple car insurance quotes at once and compare rates side-by-side.

Similarly, be careful with cheap car insurance quotes because they might not offer the same level of coverage as more expensive policies. It’s important to read the fine print and make sure you understand what’s included in your policy before you buy it.

When you’re ready to buy a car insurance policy, be sure to ask about auto insurance discounts. Many insurers offer car insurance discounts for things like having multiple cars on one policy, having a good driving record, good driving history, and more.

In addition, you can avail free auto insurance quotes or in rare cases free car insurance. These offers can be found online with a little research. On the other hand, be careful of free car insurance offers as they tend to be scams.

Free car insurance quotes are all over the internet. A good place to start your research is by reading reviews of different insurance companies. You can read customer reviews on sites like Consumer Reports and J.D. Power & Associates.

Once you’ve selected a few potential insurers, be sure to get car insurance quotes from each one. Compare the quotes side-by-side to see which company offers the best rates.

A free car insurance quote is more helpful than you’d think. It provides a way to see what you can expect to pay for coverage and it allows you to compare rates from different insurers.

The best auto insurance for teen drivers

If you’re a parent of a teenage driver, you know how important it is to find the best insurance for them. Teens are more likely to be involved in car accidents than any other age group, so it’s crucial to get them covered by a good car insurance policy.

The best car insurance for teen drivers will offer plenty of coverage at an affordable price. Make sure your auto insurance options include property damage, bodily injury, medical payments, etc.

There are multiple car insurance quotes online. But make sure you get the insurance policy you need, not just the cheapest car insurance available.

Just like home insurance, it’s important to get car insurance that includes an auto claim, property damage, bodily injury coverage, and covered accident expenses.

These are typically the most expensive types of car insurance, but they offer the best protection for you and your family.

It’s also important to get a policy with a high deductible. This will help keep your rates low, but it means you’ll have to pay more out of pocket if you do have an accident.

Don’t save on car insurance because you think you won’t have an accident. The best way to save on car insurance is to be a safe driver. Drive safely, don’t speed, and follow the rules of the road.

If you are involved in an accident, make sure to report it to your insurance company right away. Be honest about what happened and provide as much information as possible.

Filing a claim can be a long and complicated process, so it’s important to have patience and be prepared for anything.

The best car insurance companies will work with you to get your claim filed quickly and efficiently. They will also help you through the entire process, from start to finish.

Do speeding tickets affect insurance rates?

Most car insurance companies will surcharge you for speeding tickets. The amount of the surcharge will depend on the company, your driving record, and the state you live in.

In general, the surcharge for a speeding ticket is about 20% to 30% of your premium. So, if you have a $1,000 premium, a speeding ticket could increase your auto insurance rate by $200 to $300.

Some states have laws that limit how much your rates can increase after a speeding ticket. These laws are called “anti-discrimination” or “good driver” laws.

In states with these laws, your rates can only increase by a certain percentage, no matter how fast you were going.

For example, in California, your rates can only increase by 20% after a speeding ticket. So, if you have a $1,000 premium, a speeding ticket would only increase your rates by $200.

Not all states have anti-discrimination or good driver laws. If your state doesn’t have one of these laws, your rates could increase by a lot more than 20% after a speeding ticket.

To find out if your state has an anti-discrimination or good driver law, contact your state insurance department.

Do insurance policies require a vehicle identification number?

Most insurance companies will require a vehicle identification number (VIN) when you apply for auto insurance. The VIN is a 17-digit number that is unique to your car.

You can find the VIN on your car’s registration card, title, and insurance card. You can also find it on your car’s dash, near the windshield on the driver’s side.

The VIN is important because it helps the insurance company identify your car. It also helps the company determine if your car has been in any accidents or has any other damage.

Do I need to have my car inspected before I get insurance?

No, you don’t need to have your car inspected before you get insurance. However, it’s a good idea to have your car inspected by a mechanic to make sure it’s in good working condition.

If you’re buying a new car, the dealer will usually inspect the car before you buy it. If you’re buying a used car, you should take it to a mechanic to get it inspected.

Car insurance companies may require an inspection if your car is more than a certain age or if it has been in an accident.

Do I need to have my car registered before I get insurance?

Yes, you need to have your car registered before you can get insurance. You can register your car at your local DMV office.

Do I need to have my driver’s license before I get insurance?

Yes, you need to have your driver’s license before you can get insurance. You can apply for a driver’s license at your local DMV office.

Are free auto insurance good?

There is no such thing as free auto insurance. All auto insurance coverages come with a cost. The price of your policy will depend on factors like your driving history, the type of car you drive, and where you live.

Some people may be able to get discounts on their car insurance. But, even with discounts, you’ll still have to pay for your policy.

You should be careful of any company that claims to offer free auto insurance. These companies may not be reputable and may not have the financial stability to pay out claims.

It’s always best to research an insurance company before you purchase a policy. You can check with your state insurance department to see if the company is licensed to sell insurance in your state.

You can also check with the Better Business Bureau to see if the company has any complaints against it.

There is no such thing as free car insurance. All auto insurance policies come with a cost. Before you purchase an auto insurance policy, make sure you research the company to make sure it’s reputable and has the financial stability to pay out claims.

How to get a low-interest rate on a car loan

If you’re looking to finance a car, you’ll want to get the best interest rate possible. The interest rate on your loan will affect your monthly payment and the total amount of interest you’ll pay over the life of the loan.

There are a few things you can do to get a low-interest rate on your car loan:

1. Shop around at different lenders.

2. Get a cosigner with good credit.

3. Apply for a longer loan term.

4. Make a larger down payment.

5. Have a trade-in vehicle.

6. Have good credit.

If you have any questions about how to get a low-interest rate on a car loan, be sure to ask your lender. You can also check about a free quote online.

Can I get a low-interest rate if I have poor credit?

The answer is yes, you can get a low-interest car loan if you have poor credit. However, it may take some time and effort to find a lender that’s willing to work with you.

It’s important to remember that just because you have bad credit doesn’t mean you’re a bad person. There are many reasons why people have poor credit, and it doesn’t mean you’re a high-risk borrower.

There are plenty of lenders out there who are willing to work with people with bad credit. It may take some time to find one, but it’s worth the effort.

Once you find a lender, be sure to get all the terms and conditions in writing. This way, you’ll know exactly what you’re agreeing to and there won’t be any surprises down the road.

When you’re ready to apply for a car loan, make sure you have all the necessary paperwork. This includes your driver’s license, proof of income, and other financial documents.

How to Get the Best Deal on a New Car

If you’re in the market for a new car, there are several things you can do to get the best deal possible. Here are a few tips:

1. Do your research.

2. Get multiple quotes.

3. Shop around at different dealerships.

4. Don’t be afraid to negotiate.

5. Take your time.

Doing your research before you start shopping for a new car is important. You’ll want to know things like what type of car you want, what features you need, and how much you’re willing to spend. Make sure to refer to our checklist before you visit any car dealership.

Getting multiple quotes is a good way to compare prices and make sure you’re getting the best deal. You can check with different dealerships directly if they have a specific insurance company they are working with for your car insurance needs.

Shopping around at different dealerships is a good way to see what kinds of deals are available. It’s also a good way to save on car insurance or even avail of free car insurance if they have promos or offers.

Don’t be afraid to negotiate when you’re buying a new car. If you feel like you’re being offered a good deal, don’t be afraid to ask for a better price.

Take your time when you’re buying a new car. Rushing into a purchase could mean you end up paying more than you need to.

These are just a few tips to help you get the best deal on a new car. If you have any questions, be sure to ask your dealer or your car insurance company for more information. You can also check different insurance companies for promos or freebies online.

Start negotiating

Once you have your needed car insurance quotes and actual car price quotes, it’s time to start negotiating. If you’re not comfortable negotiating with a dealership, you can always bring a friend or family member who is.

You can even bring a certified car mechanic to check the car before you buy it. If there are any problems with the car, you can use that as leverage in your negotiation.

The most important thing to remember when negotiating is to be firm but fair. Don’t try to lowball the dealer too much or they’ll likely walk away from the deal.

At the same time, don’t pay more than you’re comfortable with just because the dealer says it’s a good deal. If you can’t reach an agreement, don’t be afraid to walk away. There are plenty of other dealerships and cars to choose from.

By following these steps, you can research and get quotes for cars without even leaving your house. This will save you time and money in the long run.

In Conclusion

There are many resources available to help you with your research when buying a car. These websites will provide you with detailed information, user reviews, dealer ratings, and price comparisons. Use all of these resources to find the perfect car for your unique needs.

Likewise, look for personalized service from your insurance provider. They can help you find the best coverage for your needs and budget.

Finally, don’t forget to negotiate. With a little effort, you can get the best deal possible on your new car.

Are you ready to drive your new car? We’ll help you get on the road in no time. Give us a call today!